Schedule Your Medicare Options Review

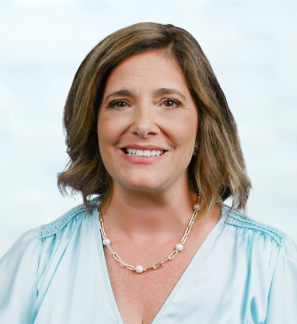

Click here to book an Appointment with Lisa Lauro, Senior Health Care Specialist at Secure Money Advisors

Hi, my name is Lisa Lauro. I help individuals understand wellness packages available as part of your Medicare choices. This includes providing an understanding of both the pros and cons of Medicare Supplements and Medicare Advantage.

Ready to learn your options? Schedule your free review today!

Lisa Lauro

Schedule Now

Click here to book a Medicare Options Review with Lisa Lauro, Senior Health Care Specialist.